Every end of the year, we are often asked, “Is ICL eligible for medical expense deduction?”

ICL is eligible for medical expense deductions.

Invoices cannot be reissued, so please keep them in a safe place.

This time I will talk about medical expense deductions.

The medical expense deduction is a system that reduces your taxable income (reduces the tax you pay) if your medical expenses paid for the year from January to December exceed 100,000 yen.

Specifically, the amount of your tax liability will be reduced by deducting 100,000 yen from your total medical expenses for the year.

The specific amount is calculated as follows:

Amount of medical expense deduction on tax return

(Medical expenses paid – Amount covered by insurance – 100,000 yen)

If there is no private insurance or other coverage, the deduction amount will be the ICL surgery cost minus 100,000 yen (※). For example, if the ICL surgery cost was 700,000 yen, the deduction amount will be 600,000 yen, which is 700,000 yen minus 100,000 yen (※).

※The maximum amount of deduction is 2 million yen. If your income is less than 2 million yen, the deduction will be 5% of your income, not 100,000 yen.

To receive the medical expenses deduction, you must file a tax return.

A tax return is a declaration of your income for the year to the tax office, and you submit the tax return to the tax office in the residential area.

The following items are required to prepare the tax return

・ Tax withholding slip

・Documents showing where medical expenses were paid and the amount (receipts, etc.)

・ My Number card

The National Tax Agency’s website has a browser program called the “Tax Return Preparation Corner,” and you can basically complete your tax return by following its instructions there.

The calculation for the tax deduction is as follows:

(Medical expenses paid – Amount covered by insurance, etc. – 100,000 yen) x Your tax rate

The main taxes paid by the general public are income tax and resident tax.

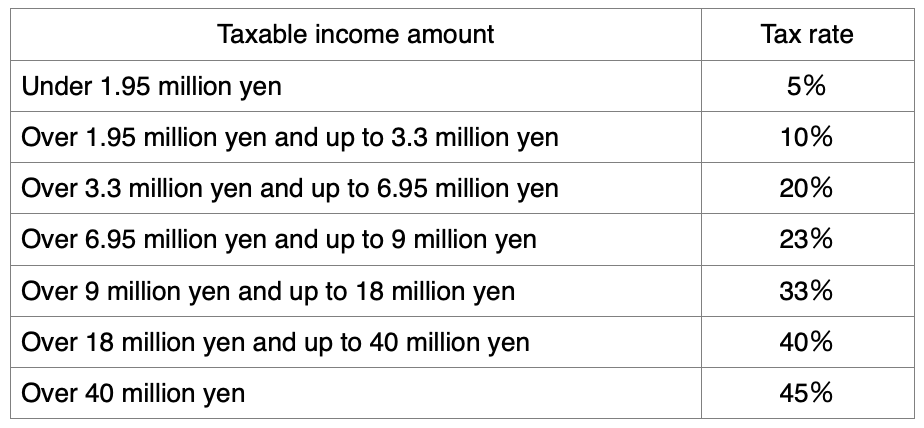

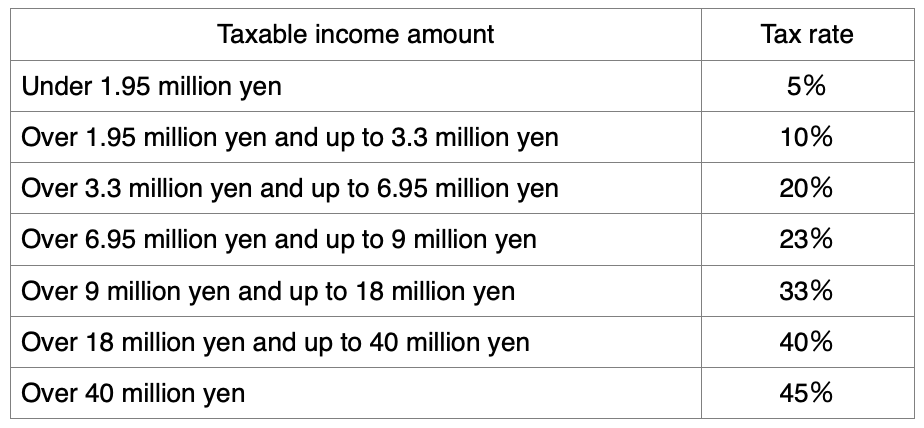

The income tax rate is shown in the table below, and the resident tax rate is a flat 10%.

According to the above income tax rate table, it is important to note that it is not based on annual income, but on the amount of taxable income.

The calculation for taxable income is as follows:

Amount after salary income deductions – Total amount of income deductions = Taxable income

Please check the above amount as it is stated on the withholding tax certificate and various deduction certificates.

For example, let’s say there is a person whose income tax rate is 20% and whose resident tax rate is 10%.

If that person spends 500,000 yen on medical expenses in a year,

(500,000 yen – 100,000 yen) x tax rate (20 + 10) % = 120,000 yen.

By applying the formula above, we can see that the amount of tax that will be reduced is approximately 120,000 yen.

Let’s look at some model cases.

*The amount will change when you take into account various income deductions such as spousal deductions, dependent deductions, and life insurance deductions, so this is just for reference.

<In the case of an annual income of 4 million yen and ICL surgery costs of 700,000 yen>

If you have an annual income of 4 million yen, your taxable income is estimated to be approximately 1.68 million yen.

In this case, the tax rate is 5%, so the calculation is as follows:

(700,000 yen – 100,000 yen) x tax rate (5 + 10) % = 90,000 yen

The amount of tax that will be deducted is estimated to be approximately 90,000 yen.

<In the case of an annual income of 6 million yen and ICL surgery costs of 700,000 yen>

If you have an annual income of 6 million yen, the taxable income is estimated to be approximately 2.98 million yen.

In this case, the tax rate is 10%, so the calculation is as follows:

(700,000 yen – 100,000 yen) x tax rate (10 + 10) % = 120,000 yen

The amount of tax that will be deducted is estimated to be approximately 120,000 yen.

<In the case of an annual income of 8 million yen and ICL surgery costs of 700,000 yen>

If you have an annual income of 8 million yen, your taxable income is estimated to be approximately 4.62 million yen.

In this case, the tax rate is 20%, so the calculation method is as follows:

(700,000 yen – 100,000 yen) x tax rate (20 + 10) % = 180,000 yen

The amount of tax that will be deducted is estimated to be approximately 180,000 yen.

For more information about medical expenses deductions, please visit the National Tax Agency website or inquire at your local tax office.

If you are interested in ICL, please come in for your initial examination and consultation.

We also hold free information sessions on a regular basis, so please feel free to contact us with any inquiries.